Tag: highest

Economics tutors, your mentors to get the highest scores!

by SALTOnline The main reason for this may be due a simple lack of understanding in certain topics or the Economics at large. If we look at the bigger picture with the pressures that are increasing with the competition most students find it difficult to do well in Economics. Parents and guardians too on account […]

UHY Air Passenger Tax Study Reveals USA’s Air Passenger Taxes Among World’s Highest

Sterling Heights, Michigan (PRWEB) June 17, 2015 Air passenger taxes in the USA are amongst the highest in the world, according to a new study by UHY, the international accountancy network. USA imposes a levy of $ 23 on short haul flights and $ 28 on long haul flights leaving the country representing Transportation […]

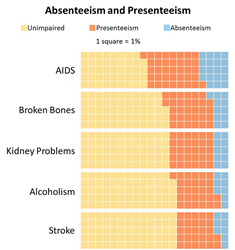

Work Productivity Loss Is Highest in U.S. Workers with AIDS, Broken Bones, According to Kantar Health Research

New York, NY (PRWEB) May 19, 2015 Work productivity loss is highest in U.S. workers who have been diagnosed with AIDS or who have broken bones, according to new findings from Kantar Health’s National Health and Wellness Survey (NHWS). The research will be presented today at the ISPOR (International Society for Pharmacoeconomics and Outcomes Research) […]

Attorney Laurence L. Christensen Earns Highest Rating from AVVO

Marietta, Georgia (PRWEB) March 09, 2015 Attorney Larry Christensen was recently rated 10.0/10.0 by AVVO for his work on behalf of clients and their families. The AVVO rating is one of the most respected in the legal industry because it is determined by a mathematical model that considers a lawyer’s years in practice, disciplinary history, […]

Ceramic Matrix Composites Market to 2019: Highest Growth Rate to be Seen in APAC followed by N.A. Says a Latest Research Report Available at RnRMarketResearch.com

(PRWEB) December 31, 2014 Global ceramic composite ceramic market to grow considerably during the last some years and is estimated to grow at health pace in coming five years. Growing consumption in APAC and North America are the factor to boost this market. Currently, North America is the largest ceramic matrix composites market followed by […]