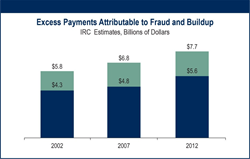

Insurance Research Council Finds That Fraud and Buildup Add Up to $7.7 Billion in Excess Payments for Auto Injury Claims

Malvern, PA (PRWEB) February 03, 2015

A new study from the Insurance Research Council (IRC) estimates that claim fraud and buildup added between $ 5.6 billion and $ 7.7 billion in excess payments to auto injury claims paid in the United States in 2012. The excess payments represented between 13 percent and 17 percent of total payments under the five main private passenger auto injury coverages.

Twenty-one percent of bodily injury (BI) claims and 18 percent of personal injury protection (PIP) claims closed with payment had the appearance of fraud and/or buildup in 2012, according to file reviewers. The most common type of abuse was claim buildup, defined as the inflation of otherwise legitimate claims; claims with appearance of buildup accounted for 15 percent of dollars paid for BI and PIP claims in 2012. Claims with the appearance of fraud and/or buildup were more likely than other claims to involve chiropractic treatment, physical therapy, alternative medicine, and the use of pain clinics.

The prevalence of apparent fraud and buildup varied widely among states, especially no-fault states. States with highest rates of fraud and buildup among PIP claims included:

Florida (31 percent)

New York (24 percent)

Massachusetts (22 percent)

Minnesota (22 percent)

“The costs associated with auto injury claim abuse make auto insurance more expensive for everyone,” said Elizabeth Sprinkel, senior vice president of the IRC. “Efforts to lower insurance costs must include measures aimed at reducing the amount of fraud and buildup in the system.”

The report details several claim handling techniques used by insurers to identify and investigate claim abuse, such as independent medical exams, peer medical reviews, and special investigative units. However, the additional costs associated with these efforts to fight fraud and buildup are not included in the IRC estimates of excess payments.

The study, Fraud and Buildup in Auto Injury Insurance Claims, is based on continuing IRC research into the causes of increased auto injury claim severity. It is based on more than 35,000 auto injury claims closed with payment under the five principal private passenger coverages. Twelve insurers, representing 52 percent of the private passenger auto insurance market in the United States, participated in the study.

For more detailed information on the study’s methodology and findings, contact David Corum at 484-831-9046 or by email at IRC(at)TheInstitutes(dot)org. Visit IRC’s website, http://www.insurance-research.org, for information about purchasing a copy of the report.

###

NOTE TO EDITORS: The Insurance Research Council is a division of the American Institute For Chartered Property Casualty Underwriters (The Institutes). The Institutes are the leader in delivering proven knowledge solutions that drive powerful business results for the risk management and property-casualty insurance industry. Institute knowledge solutions include the CPCU designation program; associate designation programs in areas such as claims, risk management, underwriting, and reinsurance; introductory and foundation programs; online courses; research; custom solutions; assessment tools; and continuing education (CE) courses for licensed insurance professionals and adjusters through its CEU business unit. The IRC provides timely and reliable research to all parties involved in public policy issues affecting insurance companies and their customers. The IRC does not lobby or advocate legislative positions. It is supported by leading property-casualty insurance organizations.

Related Physics Press Releases